Michael Burry rose to fame after correctly predicting the 2008 stock market crash, and now he is warning Americans of another financial crisis we face. Burry became popular after being portrayed in the movie “The Big Short”.

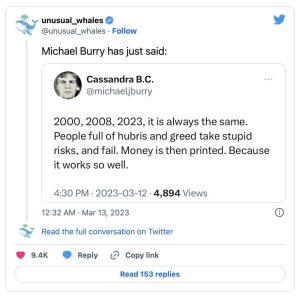

Now, he gives this warning, suggesting that 2023 is going to be like the 2000 and 2008 crashes:

“2000, 2008, 2023, it is always the same. People full of hubris and greed take stupid risks, and fail. Money is then printed. Because it works so well,” he tweeted.

Burry has been sounding the alarm for the past 2 years as money printing has led to massive inflation. Now, as these banks continue to collapse, he is suggesting the time of reckoning is near.

As we reported earlier, yet another bank has been closed by Federal regulators in light of “systemic risk”.

NEW:

*Signature Bank has been closed

*All depositors of Silicon Valley Bank and Signature Bank will be fully protected

*Shareholders and certain unsecured debtholders will not be protected

*New Fed 13(3) facility announced with $25 billion from ESF to backstop bank deposits pic.twitter.com/LKipIRMg1T

— Nick Timiraos (@NickTimiraos) March 12, 2023

Here is the joint statement by the Department of the Treasury, Federal Reserve, and FDIC:

Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Well it has started. It is only going to get worse now. Wait till there’s no food in the supermarkets. Wait till people kill people to get a glass of milk or a peace of bread. This administration was set to destroy America and it is just about done it.

You are absolutely right! The illegal government we have will “come to our aid” with the new non existent money to control us even further.

It’s time to take up arms and exterminate all federal and local democratic and most Republican officials. Only way to solve this problem, fucking kill everyone involved with dominion too!

“No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

That’s a straight up lie. Bidung is covering for the DEI idiots hired by the banks that have been pushing ESG. Screw bailing them out!