The Internal Revenue Service (IRS) is warning taxpayers and tax professionals to be on the lookout for emerging scams and protect sensitive information as the filing season approaches.

The IRS released the warning to taxpayers as it observed National Tax Security Awareness Week in concert with its Security Summit partners. The Security Summit includes 42 state tax agencies as well as other entities connected to the tax community – including tax preparation firms, software developers, payroll and tax financial processors, tax professional organizations and financial institutions. Tax filing season is expected to begin in mid-January 2024.

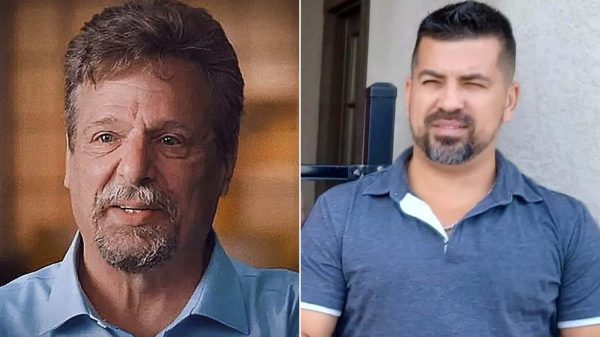

“Identity thieves are relentless and use a variety of techniques,” said IRS Commissioner Danny Werfel, who added that he would “urge people to be careful with their personal information and be wary of email and text scams.”

“With people anxious to receive the latest information about a refund or other issues during tax season, scammers will regularly pose as the IRS, a state tax agency or others in the tax industry. People should be incredibly wary about unexpected messages that can be an elaborate trap by scam artists, especially during filing season,” Werfel added.

The IRS noted that identity thieves will also use recent news events and tragedies as part of an effort to trick taxpayers.

Another common tax season scam involves identity thieves contacting tax professionals posing as new, potential clients by email or phone to access a company’s systems that could enable them to file fake tax returns to secure a refund.

Taxpayers should be on alert for phishing emails sent by fraudsters claiming to come from the IRS or another legitimate entity like a state tax organization or financial firm that looks to lure unsuspecting victims with the promise of a phony tax refund or false allegations of tax fraud.

Similarly, “smishing” messages sent via text message have emerged as a similar technique and may claim a taxpayer’s account has been put on hold or send a fake unusual activity report with “solutions” to restore the recipient’s account.

Individuals “should never respond to tax-related phishing or smishing or click on the URL link,” the IRS noted. “Instead, the scams should be reported by sending the email or a copy of the text/SMS as an attachment to [email protected].”

The IRS notes that it initiates most contacts through regular mail, so taxpayers shouldn’t be getting an unexpected message by email, text or social media about a bill or tax refund.

Partners in the IRS Security Summit also reminded taxpayers and others to never click on any unsolicited communication that claims to be the IRS or another entity in the tax community because such links can surreptitiously load malware onto the device in use. It can also allow malicious hackers to load ransomware that prevents a device owner from accessing their system or file.

At the TOP of the LIST for SCAMMERS should be the IRS itself! Like the F.B.I, it’s become a “CRIMMINAL ENTERPRISE”!

Scammers like to use these tactics: Urgency, fear and greed. “Do this now, or your account will close”, “You won!” “Your UPS package…”, “Your PayPal account…”. If you’re not sure of its validity, hover your mouse, without clicking, over the sender’s email. The scammer’s email address will not look official at all but will have strange names and symbols and not the official name of the company they claim to represent. Also, no legitimate company will ask you for your password, legitimate employees of legitimate companies already have access to your account without you giving them your password.

HeHeHe! IF IRS has your “personal” information, it isn’t any longer personal — or private.

Identify thieves crafted their trade off examples provided by the IRS, FBI, CIA, DOJ etc.

The pot calling the kettle black.

I would say tis the season for scams, however that season begins Jan 1 and never, ever ends!! It would be wishful thinking for people to be honest, decent and get a job instead of stealing from others! Especially in this age with computers, it’s so easy to ply their trade and con folks out of all their money!! I never answer any email if I don’t know who it’s from! I especially feel sorry for lonely men & women who fall for the old I can’t get out of the country…they won’t let me leave….and they know just how to manipulate and they take thousands of dollars from them.