Treasury markets are flashing a big warning that an economic downturn may be on the horizon, even as the labor market remains tight.

Benchmark 10-year Treasury yields hit 3.74% on Friday, while two-year yields inched up to 4.5%. Those two curves are inverted, meaning the shorter-term yields are higher than the longer-term ones. Yield curve inversions can portend recessions, as they show investors have little faith in growth picking up in the coming years.

In fact, the yield on the 10-year Treasury was at one point more than 0.85 percentage points below the two-year yield, which is the most inverted the two have been since 1981. The inversion is one of the most prescient warning signs that the Federal Reserve could be pushing the economy into a recession because of its quest to drive down inflation.

The yield has been inverted since early July, about four months after the Fed started raising interest rates. Since July, the Fed became even more aggressive with its tightening and conducted several consecutive three-quarter percentage point rate hikes — three times the size of a typical rate hike.

“The trend has been a flatter curve and more inversion since the Fed started tightening,” said Gregory Faranello, head of United States rates trading and strategy for AmeriVet Securities. “There’s nothing, when looking at the charts, that says we can’t go further with the inversion.”

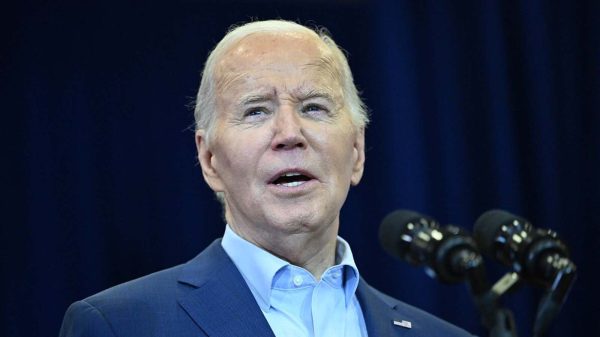

The increasingly inverted yield curve is notable because, in recent weeks, some economists have gotten more optimistic about the odds that Fed Chairman Jerome Powell can pull off a “soft landing,” that is, taming inflation while avoiding a recession.

Recent employment reports have surprised economists because they have shown the labor market humming right along and, in some respects, even gaining steam as rates rise.

Last month, the economy added more than half a million jobs, and the unemployment rate fell to 3.4%, the lowest level in decades.

While the labor market has held up, it is causing investors some concern because Powell and other Fed officials have said it needs to cool some to get inflation back to the central bank’s preferred 2% level.

Powell recently said that if the labor market remains red-hot, “It may well be the case that we have to do more.”

“We think we are going to need to do further rate increases,” Powell said during a question-and-answer session at the Economic Club of Washington. “The labor market is extraordinarily strong.”

Before last month’s jobs report, most investors expected another mild rate hike at its March meeting. More than 17% felt as though the Fed might not hike at all in March, according to CME Group’s FedWatch tool, which calculates the probability using futures contract prices for rates in the short-term market targeted by the Fed.

Now, nobody expects the Fed to hold rates where they are in March, with more than 90% predicting a quarter percentage point hike and nearly one in 10 expecting a bigger half percentage point increase.

The consumer price index report for January will come out next week. Annual inflation has been falling over the past several months from its peak of above 9% in June to 6.5% in December. Economists expect the headline number to drop to 6.2% for January.

A bigger decline would be good news for the economy and show that prices are still falling even with the strong jobs market. But if inflation ticks up or remains stagnant, it could spell bigger rate hikes down the road in 2023, raising the likelihood of a recession.

“The labor component registered a modest increase in pressures in January, confirming that the market remains exceptionally tight. We expect further Fed policy tightening as the central bank works to cool the labor market,” said economists from Oxford Economics on Friday.

The Federal Reserve is NOT a government entity and should NOT exist. Why are rich bankers aloud to manipulation the rate of US Government Bonds and consequently we suffer with no recourse? They need to be shut down and what the US Government pays in interest on its bonds must be the decision of the US Government.

To make it possible for this to happen:

(one word) CONVENTION OF STATES (dot) COM/?ref=65600

This government is simultaneously out of control and not in control. What a mess!

With Google and other big tec laying off they are out of touch with reality even Chrysler and Ford announced layoffs

Ok, I guess Americans and Christians deserve to know what’s coming soon. Shortly a Declaration of National Emergency will be claimed to the public, followed by a ruling of MARSHALL LAW. Then an order of National policing will go into effect. Not mentioning any names, but they have been known to be policing in our country just recently. So use your better judgement and try to decipher the future for yourselves. We already have, political supporters jailed in DC. This is just the beginning. There are Holding facilities in Evert state at present. This is know conspiracy THEORY. This is a warning from biblical Prophecy. Prepare yourselves for a major event, like no other in World History.

A Democrat New World Order communist global satanic United Nations and European Union planned elitist Satan worshiping planned crash so they can usher in their Antichrist demonic digital currency taking In God We Trust off money bills and using a digital controlled credit card system with their demonic symbols on it.