According to the Chief Executive Officer of a retail biometrics company based in Bucharest, Romania, a new payment method will soon be implemented in the United States.

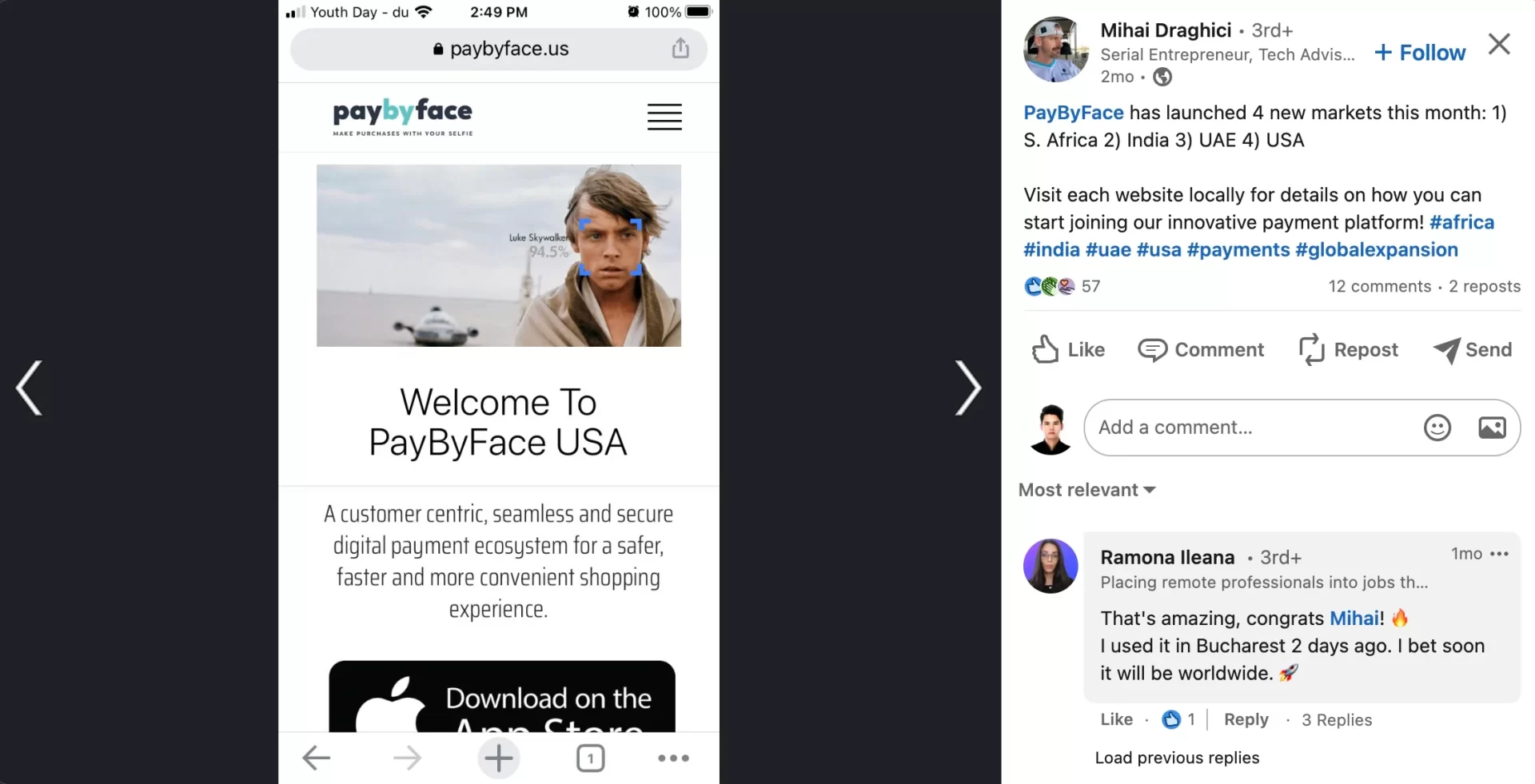

Romanian biometric firm PayByFace has deployed its face recognition-powered payment solutions in South Africa, India, UAE, and the US, according to the Biometric Update.

The news was first shared on LinkedIn by CEO Mihai Draghici last summer.

“PayByFace has launched 4 new markets this month: 1) S. Africa 2) India 3) UAE 4) USA Visit each website locally for details on how you can start joining our innovative payment platform!” Draghici wrote.

According to its website, PayByFace is a customer-centric, seamless and secure digital payment ecosystem for a safer, faster, and more convenient shopping experience. It makes purchases with a selfie, without needing cash, a card or a phone.

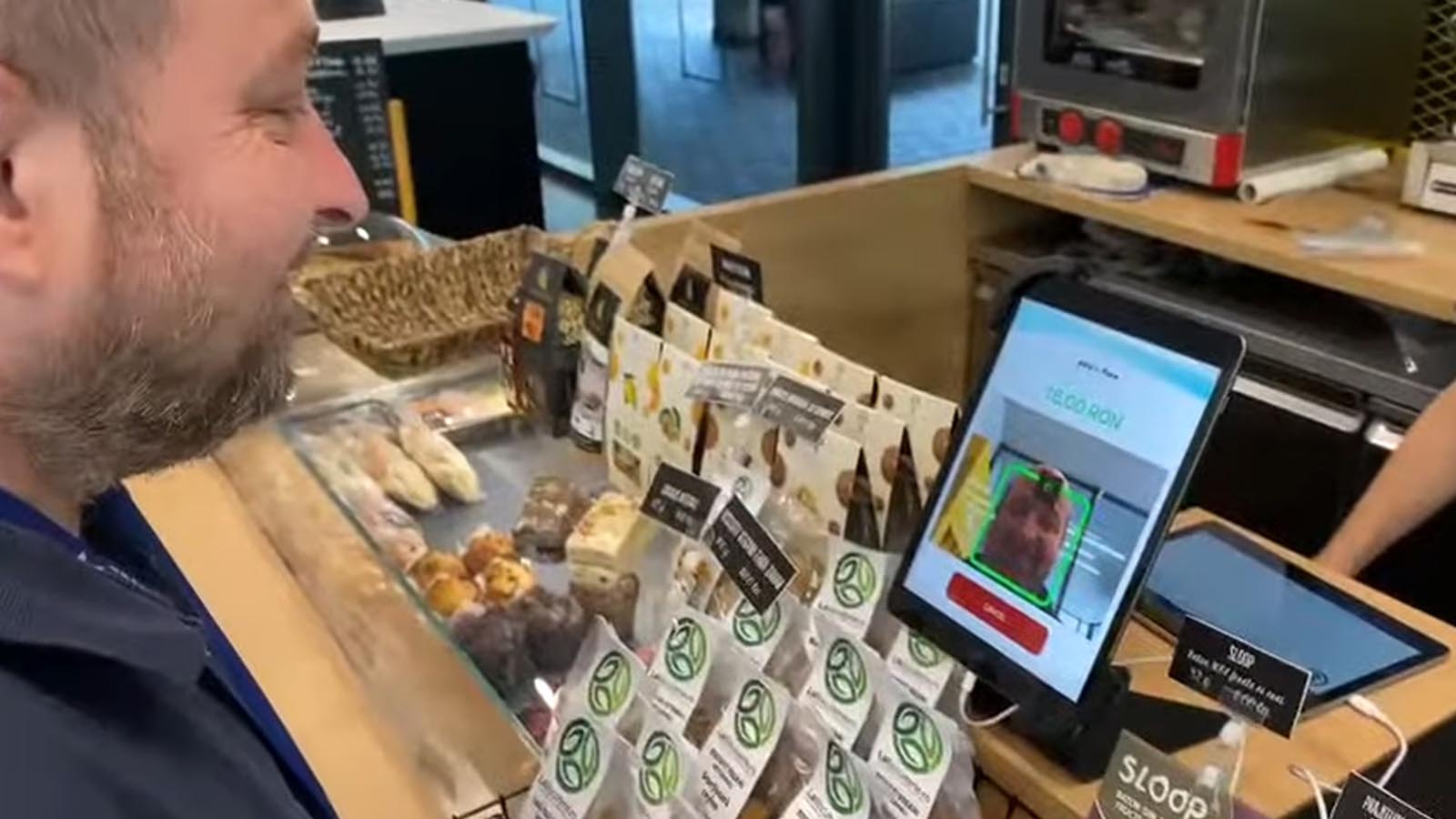

The system is currently being used in Bucharest, Romania in over 50 locations like salons and coffee shops.

Biometric Update reported:

The company’s CEO Mihai Draghici discussed the news with Biometric Update in an email interview.

“As a pioneer EU fintech start-up committed to enabling global movement towards a cashless and cardless society, using face as a highly secured virtual card, we have to go outside the EU to understand the global shoppers,” Draghici says.

According to the CEO, India, UAE, the U.S., and South Africa are dynamic markets, where retailers started to incorporate biometric payments into their point-of-sale (POS) processes to reduce friction in check-out transactions, eliminate fraud, and capitalize on operational efficiencies.

“As PayByFace, we must not only be present in these markets but lead the process with best practices and learn so as to better scale this unique solution worldwide,” Draghici explains.

Further, the CEO says that, besides simplifying payments and adding value to loyalty programs, PayByFace strives to reach superior levels of transaction security and reliability from a shopper-centric perspective.

“We offer four instant cross-check security touchpoints for validating a payment, much above the traditional means of payments we are used to; while its GDPR-compliant, the ultra-scalable on-demand decentralized architecture allows authentication in less than 1 second,” Draghici explains.

“Enhancing our understanding of how to engage core adopters across global markets will facilitate biometrics acceptance at scale,” the executive adds.

Watch the video below:

A white paper released by the World Economic Forum in January 2020 titled “Reimagining Digital Identity” emphasized the need for public-private partnerships in the development of digital identity systems and encouraged cooperation between sectors and industries such as healthcare, travel, and finance.

“From healthcare to banking to paying taxes, the repetition of the process of providing identity credentials online is not only frustrating for users but also costly and inefficient for organizations. If organizations could choose to collaborate and share their identity capabilities, society as a whole would benefit. Organizations would benefit from reducing costs and inefficiencies by improving customer experiences, enabling them to focus on building new services founded on trusted digital identity. Collaboration across the public and private sectors offers the potential to create new models of secure, useful digital identity based on user agency and user choice – models that leave no one out and leave no one behind,” according to the documents.

Vox Europ reported:

Fingerprints and facial images stored on a chip have been obligatory for EU ID cards since June 2019, yet biometrics for matters such as payments, entry to public venues and workplaces, and travel – which link to form a far more intrusive and centralised identity system – are now being promoted as the only way to return to normal amid COVID-19.

Governments and companies, while claiming that they will be optional, are threatening those who opt out with exclusion from the most fundamental of freedoms, which equates to outright coercion into a system that gravely threatens privacy and personal autonomy.

The Gateway Pundit previously reported that the Bill & Melinda Gates Foundation donated $1.27 billion to “advance progress toward the global goals” during United Nations General Assembly week last month, with $200 million going toward the development of an invasive global digital ID system.

“This funding will help expand infrastructure that low- and middle-income countries can use to become more resilient to crises such as food shortages, public health threats, and climate change, as well as to aid in pandemic and economic recovery. This infrastructure encompasses tools such as interoperable payment systems, digital ID, data-sharing systems, and civil registry databases,” according to the news release published on Gates Foundation’s website.

Only the idiots will do this.

But, there are a hell of a lot of idiots…

Unfortunately and the majority tiktok and do as their told. So do the have to have a pic with a mask? hahaha

Sheeple gonna sheep.

So you pay with your face, you don’t pay with cash or a credit/debit card.. Hmmm, now what would you do if the store, gas station or whoever doesn’t have electricity?? I guess you don’t get your purchase. Stupid. And somehow someone somewhere will turn it into a scam and you lose your identity, again.