What is the scale of the energy challenge?

We got a very shocking sense of the staggering numbers involved in the existential, crippling European crisis earlier today when Norwegian energy giant Equinor echoed what Zoltan Pozsar said in March, warning that “European energy trading risks grinding to a halt unless governments extend liquidity to cover margin calls of at least $1.5 trillion.” As Bloomberg put it, in its best non-Zoltan imitation, “aside from inflating bills and fanning inflation, the biggest energy crisis in decades is sucking up capital to guarantee trades amid wild price swings. That’s putting pressure on European Union officials to intervene to prevent energy markets from stalling.”

“Liquidity support is going to be needed,” Helge Haugane, Equinor’s senior vice president for gas and power, said in an interview. The issue is focused on derivatives trading, while the physical market is functioning, he said, adding that the company’s estimate for $1.5 trillion to prop up so-called paper trading is “conservative.””

In other words, massive amounts of newly-printed funding (because with yields blowing up, Europe’s fiscal stimulus will be over before it started unless central banks step in and backstop the latest energy hyperinflation bailout plans) will be required to avert an energy disaster. Alas, the final number will be even more massive, because overnight Goldman’s research team published a must read note (available to pro subs), in which the bank looked at the scale of the energy bill challenge, potential European government responses and industry implications, and quantified the total damage. The numbers are staggering:

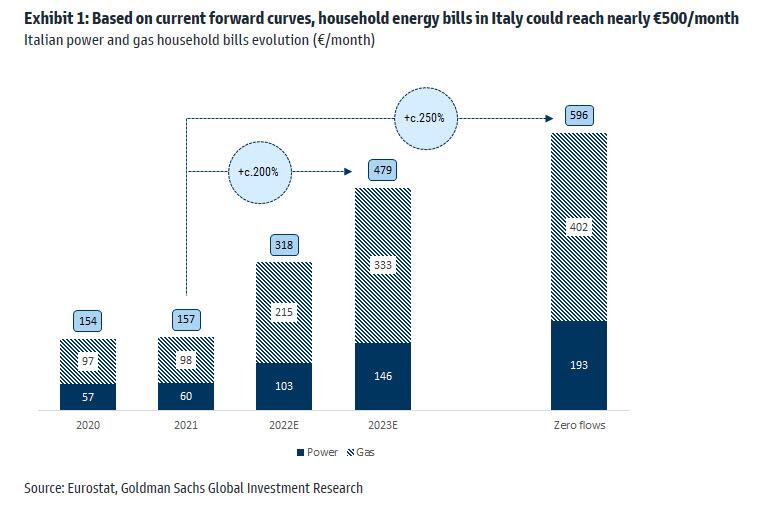

According to Goldman, Italian household energy bills could rise from ~€150 to ~€600 in 2023. Some more details:

“For most families and industrial customers, energy bills are renegotiated every twelve months; on our estimates, energy bills for most consumers will peak this winter. We estimate a c.€500/month cost for power and gas currently, implying a c.200% increase vs. 2021 when average bills were c.€160/month. Energy bills could approach €600/month in a zero flows (from Russia) scenario we believe (see here for more on this zero flows scenario). ”

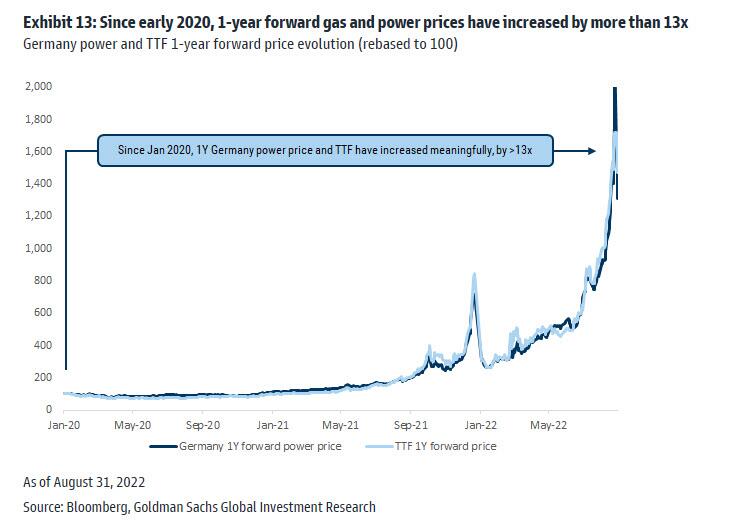

The trigger for this exponential surge in costs: since January 2020, 1-year forward gas and power prices – usually the reference when signing new energy supply contracts for families or industrial customers – have each increased by more than 13x. The following exhibit shows this evolution, rebased to 100.

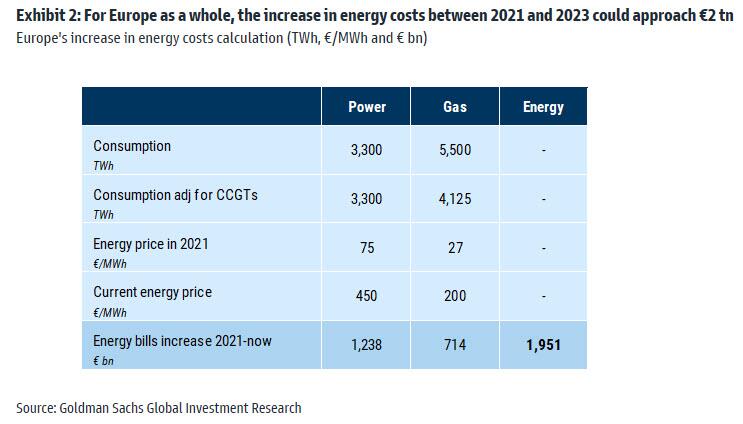

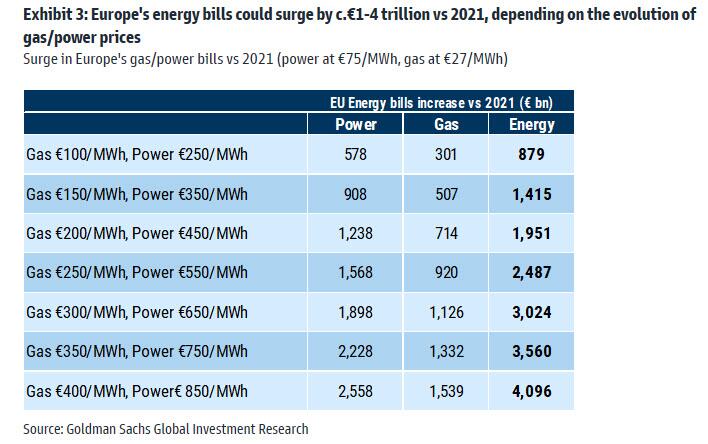

For Europe as a whole, this would be equivalent to a near €2 TRILLION increase in gas and power spending (equivalent to c.15% of GDP).

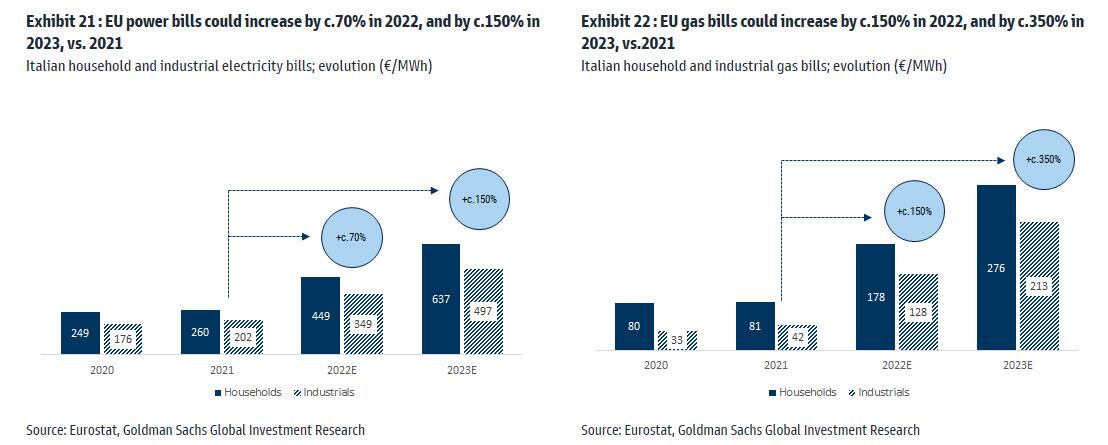

Goldman next calculates that if current 1-year forward prices remain unchanged for the coming six months, supply contract renegotiations would lift the EU’s power and gas unitary bills by c.200%, vs. 2021. As a reference, the exhibits below show (using Italy as an example) the unitary cost of energy (€/MWh) evolution of gas and electricity, for both industrial users and households.

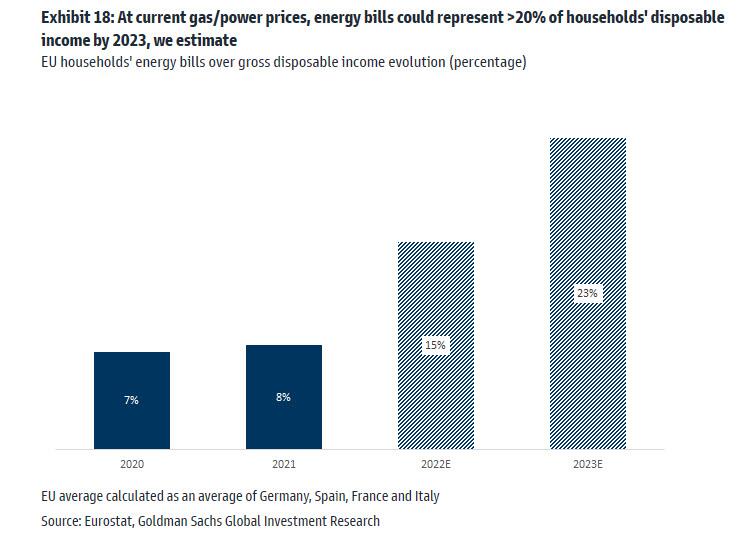

In this nightmare scenario, Energy bills would constitute over 20% of EU household gross disposable income.

The next table shows a sensitivity analysis in the surge in energy bills for Europe, depending on the development of gas and power prices.

And while Goldman does not say it, the biggest winner from this historic transfer of wealth – one which sees Europe’s standard of living implode as disposable income evaporates going instead into staples like power and heat… is none other than Vladimir Putin.

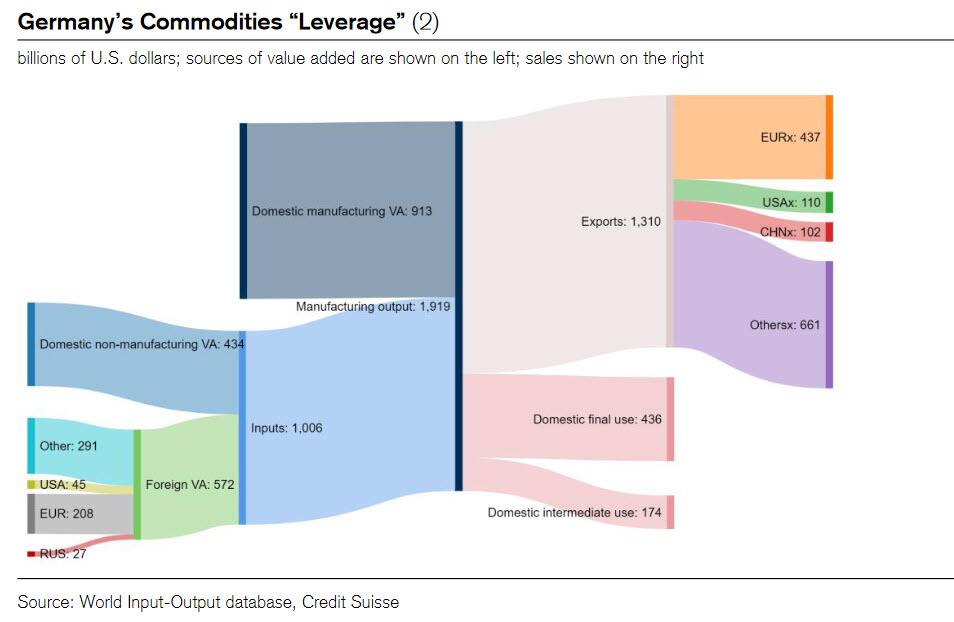

But we already knew that: last weekend Credit Suisse repo guru Zoltan Poszar published what may have been the most insightful snippet of the entire European energy crisis (to date) when he extended the infamous “Minsky Moment” framework to Europe, and specifically Germany, which he said “can’t cover its payments without Russian gas and the government is asking citizens to conserve energy to leave more for industry.” He then elaborated that “Minsky moments are triggered by excessive financial leverage, and in the context of supply chains, leverage means excessive operating leverage: in Germany, $2 trillion of value added depends on $20 billion of gas from Russia… …that’s 100-times leverage – much more than Lehman’s.”

Guess what: Russian gas will never cost $20 billion again, and meanwhile the margin call on that 100x leverage is now due.

So what solutions could governments use to cushion the consumer hit in Europe? According to Goldman, two come to mind:

Windfall tax on European utilities would have very little impact (only €30bn of income per year).

Price caps in power generation would be more effective and could save €650bn p/a. This is based on fact that a large part of power generation costs less than the marginal source of energy. These could follow the example set in Spain, where there are two co-existing caps:

a cap on gas prices that CCGTs are permitted to translate to the electricity price (c.€70/MWhg, which compares with current TTF levels of c.€200/MWhg); and

a cap on the level of remuneration fixed-cost technologies (hydro, nuclear, wind, solar) are allowed to receive (c.€75/MWh).

But price caps would not fully solve the affordability issue, as the increase in gas and power bills would still be +€1.3 tn, or c.10% of GDP on the team’s estimates.

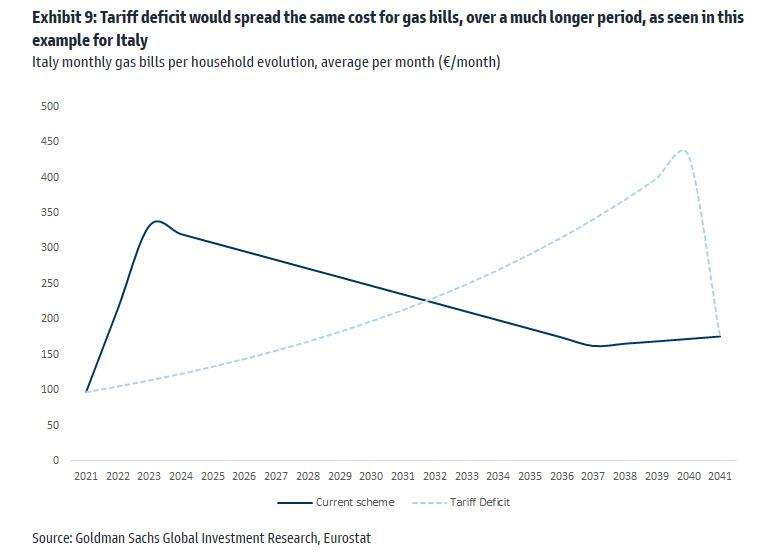

This is why Goldman believes that the introduction of a “tariff deficit” might eventually be needed, to spread the recent spike in bills over 10-20 years, and allowing the Utilities to securitize promptly these future payments. Although this scheme would limit demand destruction, it would smooth the increase in tariffs, limit the near-term decline in industrial production, and largely defuse regulatory risk.

Whatever the band aid solution that is applied, however, the reality is grim. And while we wait for the latest Zoltan note to quanity it in a way only he can, the math is simple: Europe can’t print more nat gas, oil, coal, etc, so one way or another, it will have to offset the surge in costs, first in commodities and then in all downstream chains, which in the very near future will mean governments will soon be subsidizing Europe’s cost of living as the alternative is a violent revolution. In short: we are about to see the printers go brrrr like never before, if only to prevent Europeans from going brrrr this winter…

Russia now holds all the cards. This short term Goldman Plan is a pray at best and likely a hallucination if Europe suffers a harsh winter. Ultimately, Europe must relent on Ukraine and force a peace on Zelenskyy. Sooner would be much less painful and afford some negotiating ability. If Europeans are freezing to death Russia will have them on their knees. President Trump warned them of this but they scoffed at him.

Remember when Trump predicted a lot of this crisis several years ago when he was President? I seem to remember delegates from several European Countries laughing and smirking at his comments. Now they are all scared and scrambling because Trump’s predictions have come true. Biden is complicit in a lot of this mess because, when he took office, the US was totally energy independent and able to export petroleum products overseas. Biden destroyed all that and now the US is out begging third world countries and nations that hate us to produce more oil for us to buy and competing with an ever frantic European community who knows they will run short of energy this winter. The problem is bad because the European nations ignored Trump’s advice….it may become critical because of Biden’s totally inept and incompetent handling of the America’s energy issues. Good work, Joe….once again you have demonstrate an uncanny ability to snatch defeat from the jaws of victory.

Sadly Biden, our “DEMENTED” president, will ALLOW and even ENCOURAGE America and Americans to go the same way as europe, even though America can easily be “energy independent” again and a “net exporter” or “energy” to assist our intransigent european allies(?).

It will take 10 years minimum to get people to invest in our fossil fuel industry again. By that time half the states will have banned the production and sales of fossil fuel vehicles. If the Republicans don’t get a super majority in the house and Senate, increase that 10 years to it will not happen, at all.