President Biden is reportedly planning to unveil a series of major tax hikes on billionaires, investors, and those making above $400,000 as part of his administration’s aim to reduce the deficit.

The budget request, slated for release on Thursday, calls for a 25% minimum tax on billionaires and would nearly double the capital gains tax rate from 20% to 39.6%.

The proposal, first reported by Bloomberg, would increase the top tax rate for Americans earning $400,000 from 37% to nearly 40% – reversing President Trump’s signature tax cuts. The tax rate for those earning less than $400,000 would remain the same, according to the report.

Meanwhile, rich investors – those making at least $1 million – would see taxes on their long-term investments nearly double from 20% to 39.6%. Biden’s proposal would also increase the corporate tax rate from 21% to 28%.

The plan is part of Biden’s larger proposal to cut deficits by nearly $3 trillion over the next decade, the White House said Wednesday.

That deficit reduction goal is significantly higher than the $2 trillion that Biden had promised in his State of the Union address last month. It also contrasts sharply with House Republicans, who have called for a path to a balanced budget but have yet to offer a blueprint.

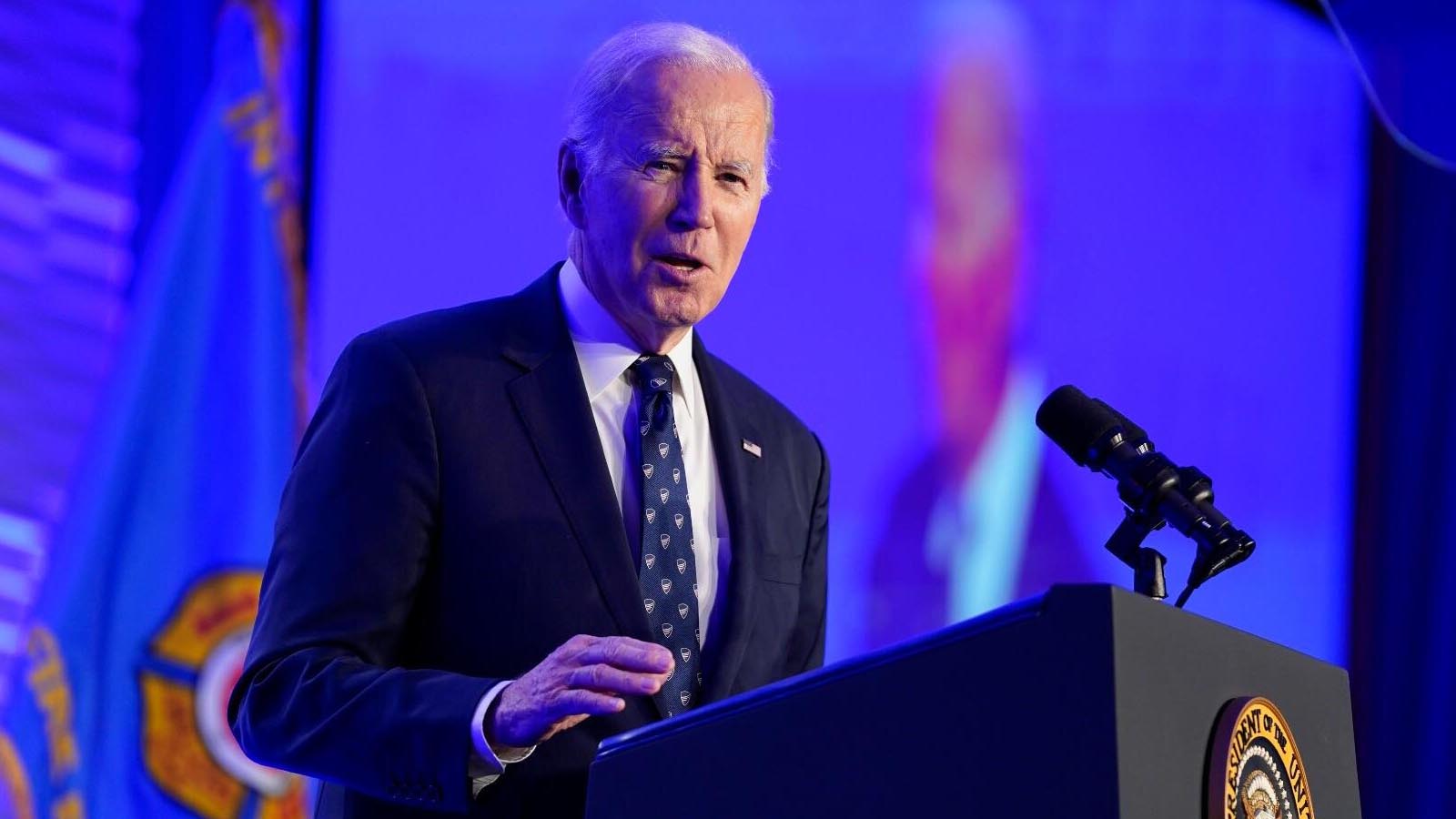

“This is something we think is important,” White House press secretary Karine Jean-Pierre said about the plan Biden intends to discuss Thursday in Philadelphia. “This is something that shows the American people that we take this seriously.”

As part of the budget, the president already has said he wants to increase the Medicare payroll tax on people making more than $400,000 per year and impose a tax on the holdings of billionaires and others with extreme degrees of wealth.

The proposal would also seek to close the “carried interest” loophole that allows wealthy hedge fund managers and other to pay their taxes at a lower rate, and prevent billionaires from being able to set aside large amounts of their holdings in tax-favored retirement accounts, according to an administration official. The plan also projects saving $24 billion over 10 years by removing a tax subsidy for cryptocurrency transactions.

Biden’s package of spending priorities is unlikely to pass the House or Senate as proposed. Senate Minority Leader Mitch McConnell, R-Ky., said Tuesday that the plan “will not see the light of day,” a sign that it might primarily serve as a messaging document going into the 2024 elections.

Without investments from the wealthy, businesses go bankrupt. When businesses go bankrupt, people lose jobs. It all comes down to screwing middle America in the long run, one way or another.

If they are serious about reducing the deficit,why not STOP sending our money to foreign countries?!

Guess none of them know about the trickle down effect.. they pay more, they have to up costs and it goes all the way down to us .. the middle class and lower…

They are lying, they distort and destroy the truth to further their political agenda. We are now a Nation run by a criminal cartel masquerading as a democracy.. democracy is dying in the darkness, and the left are the ones turning off the lights.

I laugh when I read articles such as this. The rich, global elites MAKE THE LAWS, and the loop-holes extended w/ them. They are the ones who make sure THEY DON’T PAY ANY TAX – NONE…ZERO…NADA. Anyone who believes they pay ANY taxes are either in total denial, too ignorant to understand, or too apathetic to care. IF this comes to pass, the only ones who will pay more are those making UNDER $400K. More correctly, it will be everyone making less than $250K. THAT IS FACT.